2023 CreditCon Speakers

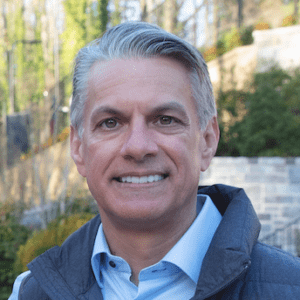

John Ulzheimer

Credit Expert

John Ulzheimer

Credit Expert

John Ulzheimer is a nationally recognized expert on credit reporting, credit scoring and identity theft, and has worked in the credit industry since 1991. Formerly of FICO, Equifax, Credit.com, and a contractor for VantageScore Solutions for 8 years, John is the only recognized credit expert who actually comes from the credit industry. He has served as an expert witness in more than 650 credit related lawsuits, has provided sworn testimony over 110 times, and has been qualified to testify in both Federal and State courts on the topic of consumer credit. John is the author of four books and thousands of articles about credit, and has been quoted thousands of times by national and regional media on credit related topics. John has presented at every CreditCon since the inception of the event

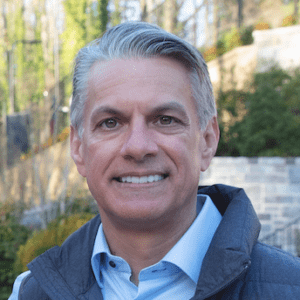

Romano Toscano

Co- Founder and CEO of VioScore™

Romano Toscano

Co-Founder and CEO of VioScore™

Romano Toscano is an experienced entrepreneur and a 20 year expert in the Artificial Intelligence space. He is the author of the upcoming book “Deal with it” to be released this year. Romano is co-founder and CEO of VioScore™ a new holistic way of looking at people’s credit score. The – patented filled – VioScore™ looks at a persons whole life instead of “just” their ability to pay off debt. VioScore™ is based on the pyramid of needs called Maslow’s hierarchy and not by the trending Social Scoring systems. VioScore™ is a unique way of looking at a person – the WHOLE person – not just their financial abilities.

VioScore™ aims to helps people with thin credit in addition to helping credit invisibles. Romano is currently in contract and under NDA with many international banks, insurance conglomerates, and multiple governments in the US and Europe.

Come and hear why VioScore™ intends to disrupt the US scoring system

Gigi Ligons

FICO – Senior Consultant

Gigi Ligons

Senior Consultant

Gigi Ligons, a Senior Consultant and subject matter expert in the FICO Scores group, works with lenders and industry professionals to help them understand, evaluate, and use FICO® Scores. Within the team, Gigi’s key areas of focus include delivering FICO® Score trainings and deploying FICO® Score solutions, services, and education for over 120 mid-tier clients.

Gigi brings to the team over 13 years’ experience in financial services from institutions including MetLife, Bank of America, Wachovia, First Union, and Washington Mutual along with an entrepreneurial acumen from her experience consulting with organizations and business leaders throughout the U.S.

She has a Bachelor of Science in Business Management, a Master of Business Administration, and considers herself a lifelong learner consistently looking for opportunities to learn something new.

Shazia Virgi

Credit Sesame

Shazia Virgi

General Manager of Credit Services for Credit Sesame

Shazia Virgi is General Manager of Credit Servcies for Credit Sesame, the first platform to provide free access to consumers’ credit scores. Shazia is a fintech industry leader with more than 10 years of experience focused on consumer finance. She is passionate about bringing financial awareness and education to the masses, to help improve the quality of life of millions of people. Prior to her roles at Credit Sesame, Shazia worked at Mint.com and a leading wealth management firm.

Paul Mezan

Attorney | Federal Trade Commission

Paul Mezan

Attorney | Federal Trade Commission

Bio

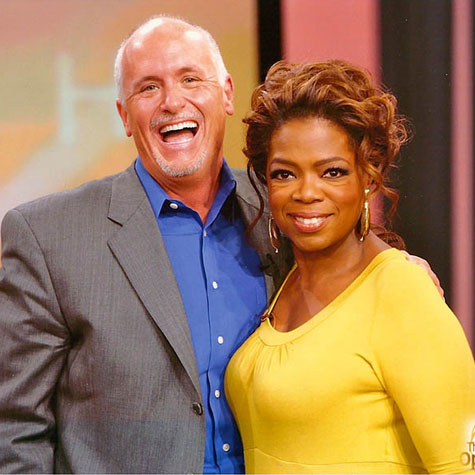

Will Bowen

Founder – Complaint Free Ⓡ

Will Bowen

Founder – Complaint FreeⓇ

Will Bowen is the founder of the Complaint FreeⓇ movement with over 12 million followers worldwide.

Will’s been featured on Oprah, Dr. Oz, Forbes, NBC’s Today Show, CBS Sunday Morning, The ABC World News, Fox News, People, Newsweek, The Wall Street Journal, and Chicken Soup for the Soul.

In July 2006, Will Bowen handed out 250 purple rubber bracelets inviting people to use them as a tool to stop complaining.

Will’s idea EXPLODED around the world and, to date, more than 12 million of his purple Complaint Free bracelets have been distributed to people in 106 countries.

Maya Angelou provided the forward for Will’s #1 International Bestselling book A Complaint Free World, which has sold more than 3 million copies in 30 languages and is required reading at many universities and businesses.

Thousands of companies worldwide have used Will’s Complaint FreeⓇ Business program to increase productivity, improve communication, and raise morale.

Will’s clients include The Million Dollar Roundtable, Volvo, and Kimberly Clark.

Will Bowen is a humorous motivational speaker, a #1 International best-selling author, a multi #1 Amazon best-selling author, an award-winning trainer, the 2016 Purdue University Executive in Residence, and he’s the World Authority on Complaining — why people complain, what’s wrong complaining, and how to get ourselves and others to stop.

Eric Kamerath

Progrexion | Senior Vice President and Chief Legal Officer

Eric Kamerath

Credit.com | Senior Vice President and Chief Legal Officer

Eric is the

Chief Legal Officer at Credit.com and counsel to Lexington Law Firm. He

also serves as the Secretary / Treasurer of the American Association of

Consumer Credit Professionals, a 501c(6) industry trade organization for the

credit repair industry. Eric has a long history with the credit repair

industry, dating back to 2005, and has worked in a variety of business and

advisory roles since that time. Eric’s primary responsibilities at

Credit.com include regulatory compliance, review of marketing materials and

service delivery, interfacing with Lexington Law’s attorney network, managing

external regulatory counsel and coordinating regulatory and government affairs.

Prior to his involvement with Lexington Law and Credit.com, Eric

practiced intellectual property law.

Joe Ziebert

FICO VP of Mortgage and Capital Markets

Joe Zeibert

FICO | Vice President of Mortgage and Capital Markets

Joe Zeibert has worked in the financial services and software industries for 15+ years, gaining experience at Bank of America and Ally Financial after starting his career at a boutique consulting and software firm. He is now a Vice President of Mortgage and Capital Markets at FICO.

Prior to joining FICO, Joe was the GM/VP of a division of a FinTech helping grow the customer base by over 100%. Before making the jump out of the banking side he was recruited to Ally Financial to help launch their brand-new Mortgage line of business and helped build it from the ground up. After the successful launch, Joe became the Senior Director of Product, Pricing, Credit & Analytics, where he managed four departments with over 40 employees. Joe was recruited to Ally from his role at Bank of America, where he ran home equity pricing, and helped bring Bank of America from the 5th largest lender in that space to the 1st largest. Prior to running HE pricing, Joe managed capital for the then $650+ Billion Dollar consumer balance sheet.

As a seasoned financial services executive, he is passionate about driving the industry forward though innovation and most specially through the use of productized analytics, delivering best in class AI/ML solutions to the world’s best financial institutions.

In addition to his financial services work, Joe is also deeply involved in his community, having served on many local non-profit boards, predominantly focused on learning and education.

Joe and his family enjoy many activities outside of work, primary among them is mixed martial arts, where he and his son are Black Belts and his younger daughter is an orange belt, though she outranks his wife who is a white belt, but will now be rising up the ranks fast.

Luscious Barbie

Social Media Influencer/Entrepreneur

Luscious Barbie

Social Media Influencer/Entrepreneur

Luscious Barbie is a native of Dallas, where she has built a large hometown fanbase by conquering the social media scene. Luscious is a comedian, actress, producer, social media influencer and community advocate. She’s appeared on MTV’s Crack Me Up, E! Fashion Emergency 2020, and has a popular Ted Talk entitled “Failing Forward”. Luscious provides unique experience-based reviews on her social media platforms that have revived many businesses in the Dallas area during the pandemic. As a viral Tik Tok influencer her videos have been viewed more than 9.7 million times. Her passion is to teach businesses on how to grow within social media platforms and within their communities.

Chad Kusner

Chad Kusner

President Credit Repair Resources

Chad Kusner is the President of Credit Repair Resources. He serves as a Board Member on the National Association of Credit Service Organizations (NACSO) and an accredited Credit Instructor. Mr. Kusner actively meets with government officials and regulators on Capitol Hill regarding NACSO issues. Mr. Kusner co-presents the annual Credit Expert Summit Event. Mr. Kusner has written publications for the National Mortgage Professional, Scotsman Guide, the Simple Dollar and Originationpro.com and has been quoted in Mortgage Professional America.

President Credit Repair Resources

Robby H. Birnbaum

Partner

Robby H. Birnbaum

Partner

Robby H. Birnbaum began his law career with Greenspoon Marder in 1998 and has practiced with the firm ever since. Mr.

Birnbaum is a Partner and Practice Group Leader of the Regulatory Compliance and Financial Services Practice Groups

and serves on the firm’s Management Committee. Mr. Birnbaum also Chairs the firm’s Health and Consumer Insurance

Sales Regulatory Group.

For over 20 years, Mr. Birnbaum has provided proactive, successful compliance strategies and outcomes to financial and

health industry clients. Mr. Birnbaum also has substantial experience in the travel and vacation resort industries,

representing and counseling some of the largest travel providers and sellers of vacation and business travel services in

the world.

Mr. Birnbaum’s practice focuses on providing comprehensive legal advice and regulatory advocacy to a broad spectrum of

clients, such as nonbank financial products and services providers; advertisers and marketers; health insurance and

health related service sellers; along with trade and professional associations. Mr. Birnbaum practices before the CFPB,

the Federal Trade Commission (FTC), offices of state attorneys’ general, state banking and financial services departments

and federal and state insurance regulators.

A substantial portion of Mr. Birnbaum’s work involves assisting clients with proactive regulatory compliance to remain out

of the cross-hairs of regulators and expensive class action lawsuits. Mr. Birnbaum immerses himself in the industries of

his clients, advising clients on how to minimize the legal risks related to providing, advertising, and marketing financial and

health insurance products and services to consumers under federal and state consumer protection laws, including laws

and regulations under the jurisdiction of the CFPB and FTC. Mr. Birnbaum’s team also assists with state licensing and

agency compliance reviews. Mr. Birnbaum regularly advises on the design of compliance management systems tailored

to specific client needs and government expectations.

Mr. Birnbaum is an experienced advertising attorney who regularly advises clients on consumer protection issues,

specifically with regard to advertising and promotions, including digital media and lead generation, as well as consumer

credit and financial services laws, privacy laws and regulations. He has extensive experience in the issues surrounding

mobile marketing, target marketing, lead generation, affiliate marketing, social media, and user-generated content. Mr.

Birnbaum has widely counseled clients on compliance with state and federal banking and insurance regulations, along

with the sweeping wave of recent state privacy law regulations.

Mr. Birnbaum focusses on defending clients in regulatory investigations and enforcement actions pursued by the CFPB,

FTC, state attorneys’ general, and other state regulatory agencies, as well as advising in private litigation involving claims,

such as false or misleading advertising, TCPA and telemarketing challenges, and unfair, deceptive, or abusive acts and

practices.

Mr. Birnbaum is heavily involved as the “go to attorney” for the debt settlement, consumer credit counseling, vehicle service contracts, seller of travel, and the credit repair industries, actively representing over 500 companies in those industries in all areas from lead generation to administrative licensing and contract fulfillment. Mr. Birnbaum also counsels the financial partners and supporting vendors of those industries, and is active in their trade associations.

Mr. Birnbaum regularly counsels private equity and venture capital funds, along with public companies on their potential investments and market activity in regard to his practice areas. Mr. Birnbaum regularly supports and serves as lead counsel and advisor on multi-million dollar buyouts and investments. Mr. Birnbaum serves as outside general counsel to many of the firms largest advertising, financial, insurance and other public companies.

Mr. Birnbaum serves as the elected president of the American Fair Credit Council, National Association of Credit Service Organizations, and the Administrator of the Vehicle Protection Association. Mr. Birnbaum is exceptionally active in Congressional and legislative affairs groups, bringing those direct insights and current updates back to the firm’s clients.

Moreover, affiliate marketing, publisher/affiliate lead generation and sales, and network referrals round out Mr. Birnbaum’s practice areas. Over the last twenty years, Mr. Birnbaum has likely resolved, without the need for litigation and to the great satisfaction of his clients, more state and federal government investigations and inquiries than any other attorney.

Mr. Birnbaum graduated from the University of Wisconsin for both his undergraduate studies and law degree. He resides

in Boca Raton, Florida, practicing from the firm’s Boca Raton, Fort Lauderdale, and Miami offices.

Steve Reger

Senior VP | Consumer Direct and SmartCredit

Steve Reger

Senior VP | Consumer Direct and SmartCredit

After 26 years with TransUnion, Steve retired as Trans Union’s Senior Director for Consumer Services and Fraud Victim Assistance in 2015, overseeing 200+ agents and support staff. Steve is a leading authority on credit reporting, financial crimes, identity theft, synthetic identities and credit repair. He is regularly called upon by law enforcement and bank investigators to assist with investigations. In 2012 he was recognized by the Director of the FBI for his invaluable contributions to a multi-year investigation of complex synthetic identity fraud. Steve is a P.O.S.T. certified trainer for the State of California and has led hundreds of presentations to consumers, banks, law enforcement and other government agencies on the subject of credit reporting, credit monitoring & financial crimes. At TransUnion Steve was responsible for the oversight of consumer initiated FCRA litigation brought against TransUnion and most expert witness testimony. Steve has testified or been deposed in more than 600 court cases throughout the United States. Steve has been interviewed by numerous leading newspaper, magazine and electronic print media including MSNBC, Reader’s Digest, Money Magazine, Kiplinger, New York Times, Boston Globe and Chicago Tribune. He has appeared in both television and radio segments.

Matt Liistro

Credit Admiral Software

Matt Liistro

Credit Admiral Software

Matt Liistro is Co-Founder of Credit Admiral Software and a 28 year veteran of the Credit Repair Industry. Matt is the organizer of the annual CreditCon Event. Matt is a published author appearing in numerous publications including The New York Times, Yahoo Finance, Dow Jones Marketplace, and The Washington Business Journal. Matt has served with NACSO (National Association of Credit Service Organizations) and is currently a Director with AACCP (American Association of Consumer Credit Professionals. Matt has been active in credit repair legislative efforts in both Georgia and Illinois. Matt currently has authored a petition with the Federal Trade Commission to change the Telephone Sales Rule. Matt currently has a petition pending with the CFPB to modify the Fair Credit Reporting Act. Matt’s expertise lies in the credit disputing process. Matt is passionate about uniting credit industry professionals and the sharing of credit knowledge.

Jeremiah Davis

CEO & Founder of Davis Thorpe & Associates

Jeremiah Davis

CEO & Founder of Davis Thorpe & Associates

Jeremiah Cromwell Davis II: Jeremiah has held sales and management positions with advertising agencies, retail stores, and telecommunications companies, giving him experience-based insight into a wide range of industries. He went from an outside sales rep to VP of Sales and Business Development, in less than 8 years with a bank card processing company. Here he fine-toned his consulting and coaching skills, which led him to start his business consulting firm in 2015. Jeremiah has a master’s degree in theology and holds Business Consulting, Business Coaching, Business Credit, and Personal Credit Certifications. Jeremiah is the Founder and CEO of 4 Businesses, Davis Thorpe & Associates, Black Label CRM, Business Funding Now, and Custom Executives.

United State Government

Enforcement Officer

United State Government

Enforcement Officer

We are withholding the identity of this enforcement officer. This US enforcement officer will talk about an ongoing investigation into a fraudulent practice in the credit repair space. Learn about this fraud and why you should avoid it at all cost – you don’t look good in an orange jumpsuit!

Dave Herbert

FICO Score Subject Matter Expert

Dave Herbert

FICO Score Subject Matter Expert

Dave Hebert is a FICO® Score subject matter expert responsible for supporting FICO’s relationships with its clients in the US. As a key subject matter expert in the FICO® Scores Teams, Dave works with top-tier lenders in the U.S. to help them evaluate and implement FICO scoring solutions. Dave ashas been actively involved in research, technology, and analytics for over 30 years having held executive level management positions at a variety of technology companies ranging from Microsoft and First Data Corporation to analytics and artificial intelligence startups. Dave is currently a Director of Business Development and Consulting in the FICO® Scores Team.

Bonnie Canty

Attorney | National Association of Certified Credit Councelors

Bonnie Canty

Attorney | National Association of Certified Credit Counselors

Bonnie teaches extensively for the National Association of Certified Credit Counselors. Bonnie currently serves on the Board of Directors of the Society of Financial and Career Counseling Professionals and has been a Certified Financial Counselor for almost two decades.

Donna Perkins

NACSO

Donna Perkins

NACSO

Donna is Vice President of The National Association of Credit Service Organizations (NACSO). Donna has been in the Credit Industry for over 20 years and has been a recognized credit education expert. Donna also has served on the Congressional Committee Small Busienss Advisory Board.

Flame Newton

Founder of The School of Credit

Flame Newton

Founder of The School of Credit, Access The Money, and Flame Newton Corp.

Flame Newton who is known for his vast knowledge in the credit system built by the United States. He wrote the book THE SCHOOL OF CREDIT “Learn and Master the 12 Levels of the American Credit System” and La Escuela De Credito:(Spanish Edition) also has The School of Credit Learn and Master the 8 levels of the Business Credit System which(permitted) him to become the ONLY author in American history to have two books recognized by the Library of Congress. He is a true “Renaissance Man”. He resides in Phoenix, Arizona and is a proud college graduate of North Carolina A&T State University. His energetic personality, broad knowledge, and agile intelligence allow Mr. Newton to successfully fill many roles for different people.

Nationally recognized as America’s # 1 credit educator. Flame has first-hand knowledge of the inner workings with banks, collection agencies, credit bureaus, mortgage companies, law firms, medical providers, insurance companies, credit card companies, car dealerships and any other institutions that deals with credit. he is also an expert in LAW as it is interpreted by the Federal Trade Commission, Fair Debt Collection Practices Act and the Fair Credit Reporting Act. He teaches primarily how to leverage your personal credit to tie it to business credit and attach to these banking institutions to gain hundreds of thousands of dollars if not millions to grow our businesses in America.

His determination has repositioned and set him apart from everyone else in the credit field. He has a strong desire for teaching with passion that gets you excited about learning about credit. He wanted to share a never seen before type method that has shaken up the credit world. Flame Newton reputation as the man to call when you want to understand this complicated credit system.

Jason Steele

CardCon Event and Freelance Credit Card Writer

Jason Steele

CardCon Event and Freelance Credit Card Writer

Jason Steele a full-time freelance writer and consultant and an expert in credit cards, travel, and general personal finance. Jason has been writing about credit and credit cards since 2008 and is widely recognized as one of the leading experts in this industry. Jason also produces CardCon, which is The Conference for Credit Card and Consumer Credit Media.

Ryan Fox

CEO of The Fox Group Enterprises

Ryan Fox

CEO | The Fox Group Enterprises

Miss Ryan Fox AKA “The Real Estate Fox”, is the powerhouse broker & CEO of The Fox Group Enterprises Inc and founder of the Real Estate Fox Academy (REFA).

Headquartered in Beverly Hills, California, she is one of the few black female owned real estate firms in the city. Ryan and her team specialize in commercial property, luxury homes, as well as credit education

Subhan Tariq, Esq.

The Tariq Law Firm, PLLC

Subhan Tariq, Esq.

The Tariq Law Firm, PLLC

Subhan Tariq, Esq. regularly handles complex commercial litigation, with particular experience in consumer finance litigation in individual and class action cases in the areas of federal and state consumer protection laws. Mr. Tariq has successfully helped thousands of consumers exercise their rights against large institutional banks, debt collectors, and consumer reporting agencies.

Mr. Tariq consults with other lawyers and law firms on blockchain automation, working towards a streamlined efficient network of client files, document automation, and cost-effective workflows. He also is a leading consultant in the cryptocurrency space, providing in-depth analysis of the latest regulations and opportunities around the world.

Notable Decisions:

– Bah v. Apple Inc., 2020 U.S. Dist. LEXIS 22867

– Ranginwala v. Citibank, N.A., 2020 U.S. Dist. LEXIS 22942

– Rice v. Resurgent Capital Servs., L.P., 2017 U.S. Dist. LEXIS 20932

– Khan v. Equifax Info. Servs., LLC, 2019 U.S. Dist. LEXIS 100119

Chris Jimenez

Vice President of Sales

Chris Jimenez

Vice President of Sales

Chris Jimenez has been focused on merchant acquisition at BankCard USA for almost 10 years. As Vice President of Sales, Chris customizes industry-leading electronic payment solutions for merchants in a variety of industries. Backed by a personally-crafted business strategy and growing team devoted to providing scalable processing systems, Chris strives to elevate and enhance the financial landscape for any business, large or small. His long-standing history in the credit card processing field, first as a business owner and then as an account provider, has given him invaluable insight and experience on both sides of the statement, fueling his passion for delivering innovative payment platforms.

James Wilhite

Founder of Pre-Arbitration Academy

James Wilhite

Founder of Pre-Arbitration Academy

James has been in the credit industry for 11 years as CEO of Meta Credit USA. In the last two years James has developed a niche in the credit space – the Pre-Arbitration method. James has worked closely with attorneys for the past 2 years to develop a road map for credit repair companies to follow when helping consumers navigate Arbitration. In 2022, James is launching the Pre-Arbitration Academy at CreditCon to help companies navigate this process. Most companies do not know that you do NOT need to be an attorney to represent a consumer in Arbitration. Almost all major bank cardholder agreements have an Arbitration clause. James is working within the industry to help consumers with this new tactic. The Pre-Arbitration Academy will level the playing field between the average consumer in need of a fair shake and the large companies who might be taking them for granted or conducting business out of compliance with respect to consumer rights.

Ron Howard

SoTellUs Executive

Ron Howard

So Tell Us Executive

SoTellUs’s revolutionary review system allows you to get 1,000’s of powerful video, audio, and written reviews instantly and in seconds. Reviews are crucial to your business. With everyone saying their services or products are the best and so much competition out there, you need to stand out. This review system turns your clients and speaking audiences into sales reps for you. When people watch these powerful, in-the-moment video reviews, they will believe you are the right match for them! The proven results: an increased conversion of 84% on website! Your 4 and 5-Star reviews will automatically show up on your website, and then be pushed through to social networks. SoTellUs also SEOs your top reviews for Google and other search engines.