Meet The 2019 CreditCon Las Vegas Speakers

Cristian deRitis, PHD

Senior Director – Moody’s Analytics

Julie Wooding

FICO

John Ulzheimer

Credit Expert

Jesse Leimgruber

Co-founder Bloom

John McNamara

Assistant Director, CFPB

Robby Birnbaum

Greenspoon Marder

Ryan Christiansen

Vice President of FI Data Solutions

Rusty Breese

CEO of ScoreNavigator

TERESA DODSON

Founder Greenbacks Consulting

Derrick A. Harper

Point Boosters

Donna Perkins

NACSO

Damon DeCrescenzo

Co-founder and CEO of The Credit Pros

Mark Sher

Your Family Bank

Mark Sher is a Registered Financial Consultant; he graduated with a degree in business from the University of Miami. Mr. Sher has over 15 years of experience helping clients with the creation, preservation and the distribution of wealth utilizing specific financial, insurance, and tax-efficiency strategies.

Mark is a highly regarded speaker on the subject of Financial Literacy; his last engagement in Las Vegas was at the Money Show this past May.

Mr X.

Credit Convict

From a Credit Convict to a Credit Guru, Mr X was convicted of Aggravated Identity Theft, Bank Fraud and Money Laundering which landed him in federal prison. But this story goes a little deeper than your regular Identity theft. Prosecutors were amazed that Mr. X stole the identities of only people with sub 600 credit scores! Mr. X actually improved the credit scores of his victims first! Come hear about Credit fraud from the fraudsters perspective from this convict turned credit guru! You don’t want to miss this never heard before story.

Chad Kusner

President Credit Repair Resources

Chad Kusner is the President of Credit Repair Resources. He serves as a Board Member on the National Association of Credit Service Organizations (NACSO) and an accredited Credit Instructor. Mr. Kusner actively meets with government officials and regulators on Capitol Hill regarding NACSO issues. Mr. Kusner co-presents the annual Credit Expert Summit Event. Mr. Kusner has written publications for the National Mortgage Professional, Scotsman Guide, the Simple Dollar and Originationpro.com and has been quoted in Mortgage Professional America.

Deric M. Dandridge

Dandridge Seminars Training Group

Deric Dandridge is the former CEO of Credit Resurrectors LLC and the retired President of Auto Dreams LLC. He spent 20 years enjoying his passion of helping people with credit issues and 23 years in the automotive industry as an auto broker. Deric is the author of the #1 booklet of its kind The Dark Side, “Secrets The Used Car Dealer Doesn’t Want You To Know.” In the booklet Deric shares secrets that can help consumers save thousands of dollars and how to avoid the pitfalls of buying a clunker, and why having good credit is vital. You can catch him on his 2019 seminar tour.

Lisa Warner

CEO Credit Supply

Lisa is the CEO of Credit Supply and has helped over 100 Credit Related business owners. Lisa is a prior Business Development & Brand Vice President who built businesses from conception to million-dollar companies. Lisa is an expert in social media marketing and has spent more than 10 years creating marketing content, managing professional graphic artists, and creating brand concepts. Lisa is well versed in creative tools and can quickly brand, conceptualize a marketing trend and or idea and bring it to life. Lisa is also a content writer and motivational speaker.

Ron Howard

SoTellUs Executive

SoTellUs’s revolutionary review system allows you to get 1,000’s of powerful video, audio, and written reviews instantly and in seconds. Reviews are crucial to your business. With everyone saying their services or products are the best and so much competition out there, you need to stand out. This review system turns your clients and speaking audiences into sales reps for you. When people watch these powerful, in-the-moment video reviews, they will believe you are the right match for them! The proven results: an increased conversion of 84% on website! Your 4 and 5-Star reviews will automatically show up on your website, and then be pushed through to social networks. SoTellUs also SEOs your top reviews for Google and other search engines.

Matt Listro

Credit Admiral Software

Dan Sater

CEO Credit Scoring Advisor

Daniel Sater is an Author, Speaker, Educator, and Nationally Recognized Credit Expert. He is a Certified FICO® Professional, a Credit Expert Witness, and founder of Credit Scoring Advisor. Dan has over two decades of experience has been an advisor and coach to numerous Credit Repair companies across the country. In an audit of client results in 2017 & 2018, Dan achieved an 87.64% and an 85.21% average deletion rates! Come learn how he does it!

Dan is the Chairman of the Education Committee for NACSO – the National Association of Credit Service Organizations. Dan has developed the Certification Exams for the organization, including the Certification Exam in Credit Scoring and the CROA licensing Exam. In 1997 he got involved studying the FICO scoring risk model. After many years of study and analyzing thousands of credit reports, he developed an extensive knowledge of how the FICO model works as well as the Consumer Reporting Agencies and their e-Oscar system.

Andre Coakley

CEO Credit360

Andre Coakley is the CEO and founder of Credit360 and the 7-Figure Start up Academy. Andre’ Coakley has spent over 20 years helping clients obtain and rebuild excellent personal and business credit profiles. Over the years, he has analyzed over 500,000 credit reports giving him extensive knowledge on credit trends. However, what Andre’ found out is… That it costs five times as much to attract a new customer, than it is to keep an existing one. The first rule of any business is to retain customers and build a loyal relationship with them, and thereby avoid customer acquisition costs.

Through the 7 Figure Start Up Academy, Andre has personally worked with more than 400 organizations in multiple countries. Andre knows how to engage and inspire leaders and team members through his keynotes, workshops, books, and online courses. Andre’ equips companies with the tools necessary to retain customers which result in higher employee engagement and platinum customer service experiences. He challenges businesses to dig deep to find and release their inner brilliance personally and professionally to reduce customer churn and increase revenue.

Jimarcus Blandin

FYI Business and Financial

Jimarcus Blandin is the founder of Wealthy Mindset University, best-selling author of Good Credit is Cool Great Credit is Sexy, and a serial entrepreneur since the age 8 with over 16 years’ experience as a consultant. His brand includes multiple companies and JV partnerships including the FYI Financial Brands, Conversion REI, and more. As a well sought after global business & mindset coach, recently stamped as a top mega business coach and speaker by the world’s #1 wealth & business coach JT Foxx, he has coached over 250+ credit related business owners to help them brand, scale, and grow their businesses. Jimarcus holds degrees in Int’l Business, Finance, and a MS in Software Engineering Mgt while still acts as a Gov’t Executive Consultant and former Financial Disposition Analyst in the healthcare industry. He has an extensive knowledge of all things medical as it relates to finance & credit. Jimarcus is a philanthropist with a keen focus on giving back as much knowledge as possible and helping the community by creating programs that have helped (to date) over 45+ girls achieve over $2 million in scholarships. He serves a board member of several non-profits associated with expressing financial literacy and empowerment our youth.

Ty Crandall

CEO Credit Suites

Aaron Christopher (“AC”) Evans

CEO and Founder of Drips

Drips is a thought leader in drip marketing, conversational messaging, and marketing automation. AC is a pioneer of conversational messaging through SMS. AC is a perpetual entrepreneur and has spent nearly 20 years on the cutting-edge marketing strategy development.

AC has leveraged his expertise to build Drips, the AI-driven performance marketing platform providing lead conversion automation through voice, email, and SMS. Drips technology improves lead-to-call conversions and reduces overall lead generation costs by turning leads into high-intent inbound calls. In just two years, Drips has held over 250 million conversations for brands across the nation. Drips helps clients increase lead conversions by communicating with their customers in the same ways that people communicate with each other.

Tareka Coney M.Ed

Founder Coney Business Enterprises

From educator to small business credit expert, Tareka Coney is known as the small business credit expert. She is the owner of Coney Business Enterprise and Women Entrepreneur Factory. From the classroom to the boardroom Tareka has found the importance of credit. When life began to happen. Instead of being another statistic, Tareka invested in herself by spending over 40k in one year to make sure she was an expert in her field.

Tareka currently has mentored over hundreds of small business credit repair owners to help build strategies that will impact their business in a way that they will operate in compliances and being a beacon of hope to get started in their business.

Tareka is constantly impacting her community daily by serving on many boards publicly and privately to meet the needs of her community. She has partnered with major corporations like BB&T bank to bring financial literacy and business education to small business leaders and entrepreneurs.

Tareka also spends her time in her community collaborating with other professionals, creating partnerships and securing sponsorships.

Tareka believes in “The power of collaboration” when we work together we succeed together. A win for you is a win for me. We must be willing to learn from other people in the same industry to help grow our network and knowledge base.

Elle Williams

Founder EduSolutions

Elle A. Williams, known by her tribe as The Credit Educator, is the owner and founder of EduCredit Solutions, Nationwide College Solutions, and LA Credit, Capital and Consulting. A Certified Credit Professional, Small Business Funding Specialist, and Business Mentor; she is based in the heart of Southern Louisiana and for over a decade has gained in-depth experience in the education, finance real estate and business space. Elle obtained her BA in Education from Southern University A&M and a Master’s Certification from the University of California Los Angeles. She started her career as a classroom teacher, but eventually left the k-12 environment to start her first company, an Independent Educational Consulting Firm. Shortly after, she ventured into insurance, property management, and real estate development becoming the on-site and team credit specialist and financial consultant assisting individuals and families interested in rent-to-own and the home buying process.

Today, along with overseeing her companies, Elle focuses on business building. She mentors aspiring and existing business owners and entrepreneurs across the nation in the areas of accountability, profitability, and scalability. She assists her clients with developing systematic processes, content creation, product development, online and offline engagement, and networking and collaboration for better business and relationships.

Brandy Thorpe

Founder Legacy Credit

Brandy Thorpe is the founder and owner of CP&T Investments (a real estate investment company), CP&T Trucking, Legacy Credit, and owner/operator at Point Boosters! She works with the Kansas City Housing Authority to help improve section 8 tenants credit scores and position them from Section 8 to homeownership. Bad credit decisions in her earlier life can be contributed simply to the lack of information and education. It was only after much studying, training, and education that she was able to repair and restore both her and her husband’s credit. She then leveraged their credit by creating a real estate portfolio compiled of both residential and commercial real estate properties, a Trucking business that improves the infrastructure of Kansas City, a credit repair business that repairs and education families on improving their credit, and business funding to assist small business owners with access to the capital needed to scale their business. Brandy also mentor’s other business owners and other than her family, her inspirations are her desire to see others in her community thrive by learning not only how to improve their credit, but how to use their credit to building wealth, and legacies for their selves and families.

Steve Reger

Senior VP SmartCredit

Doug Minor

Founder Easy Credit Relief

Doug has spent over 30 years reviewing and analyzing personal credit reports. Doug has been involved in over 100 credit related court cases for credit reporting, credit scoring, and credit damages. Doug is a member of the Forensic Expert Witness Association. Doug has published numerous books on the subject of credit and has been quoted in Zillow.com, Yahoo Finance, FoxBusiness.com, CreditCardForum.com, CardRatings.com, CreditCardGuide.com, Entrepreneur magazine, and many more.

Mark Clayborne

Author | Lead Generation and Marketing Expert

Kelly Wells

Founder Credit Resources of Washington

Kelly is the Founder of Credit Resources of Washington. Kelly has 13 years of experience in the credit repair space as well as years of experience in the mortgage and tax preparation industries.

For the past 4 years Kelly has found a passion of assisting consumers with their finances through Financial Fitness and Act 4 Financial Freedom. Using her extensive credit knowledge, combines with her banking and tax experience, Kelly is a prolific instructor on all things credit and finance. Kelly is a certified continuing education instructor in the state of Washington.

MORE SPEAKERS COMING SOON

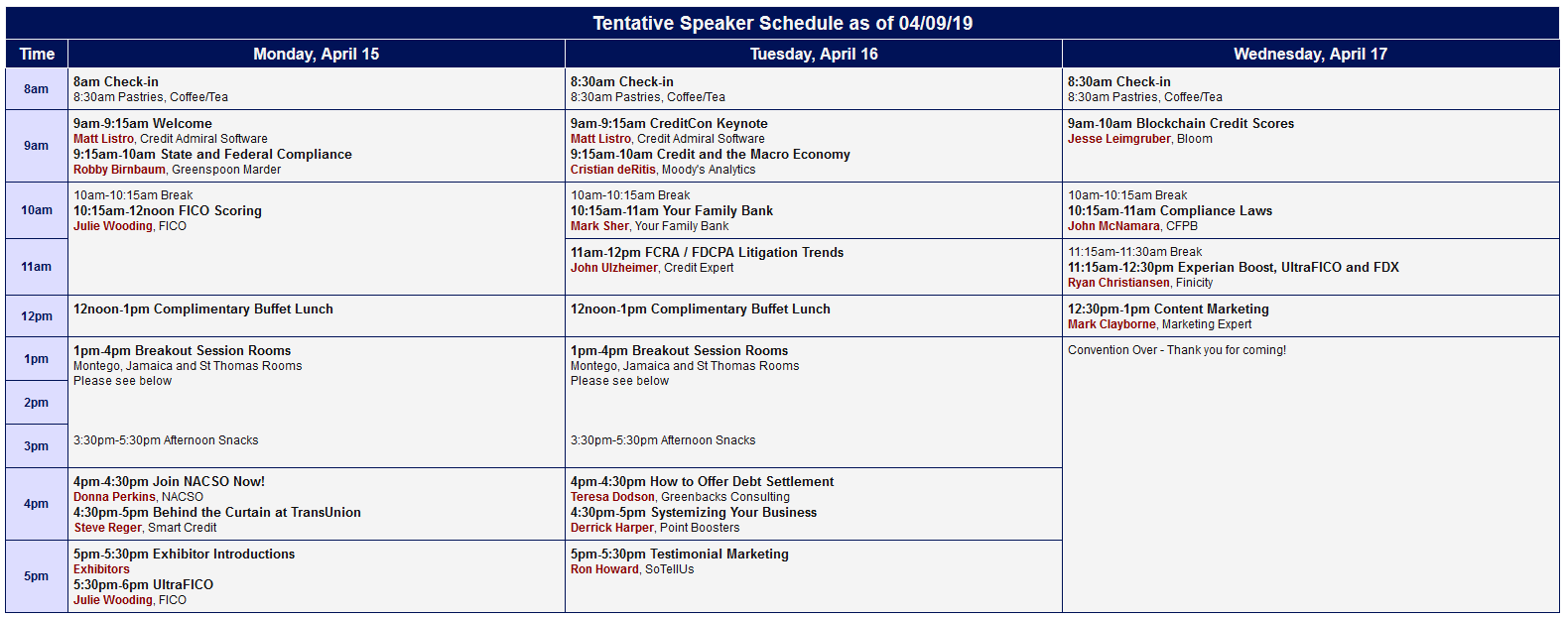

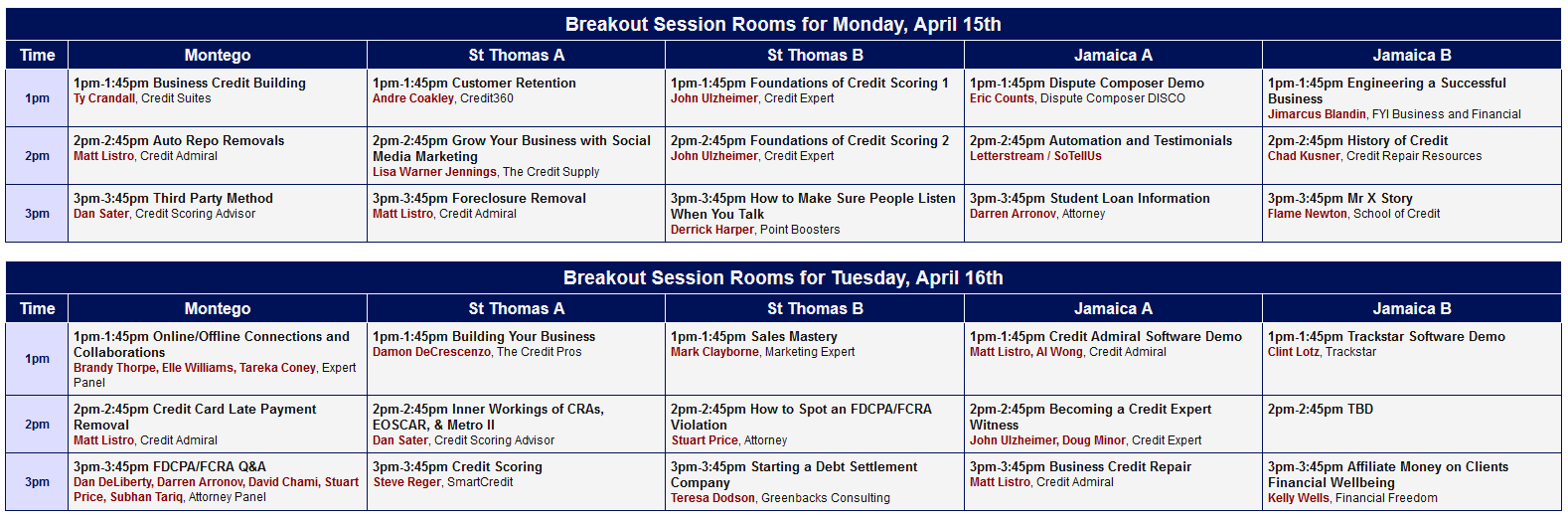

Speakers Schedule