2021 CreditCon Speakers

Francis Creighton

President & CEO CDIA – Consumer Data Industry Association

Anthony Galie

Master Sales Trainer

Merrill Chandler

CEO – GetFundable.com

John Ulzheimer

Credit Expert

Robert Stevenson

Experienced Business Authority and Author

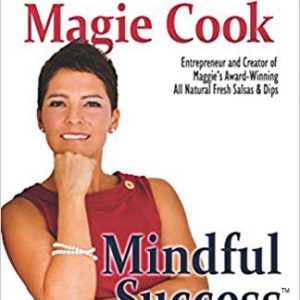

Maggie Cook

Homeless to Millionaire

Richard Hudson

Managing Partner at Ignite Consulting Partners

Steve Reger

Senior VP | Consumer Direct and SmartCredit

Steve Palmieri

Founder | Pre Litigation

Ty Crandall

CEO Credit Suites

Robby Birnbaum

Partner – Greenspoon Marder Law Firm

Lisa Warner

Credit Supply – CEO

Dion Delauder

Developer – Kraken Automations

Liz Schrum

AACCP Spokesperson

Rachel Kugel

The Kugel Law Firm

Mike Cardoza Esq.

The Cardoza Law Corporation

Angel L. Lluvet

Miami Realty Law Group

Subhan Tariq, Esq.

The Tariq Law Firm, PLLC

Robert Sigman

Credzu Founder

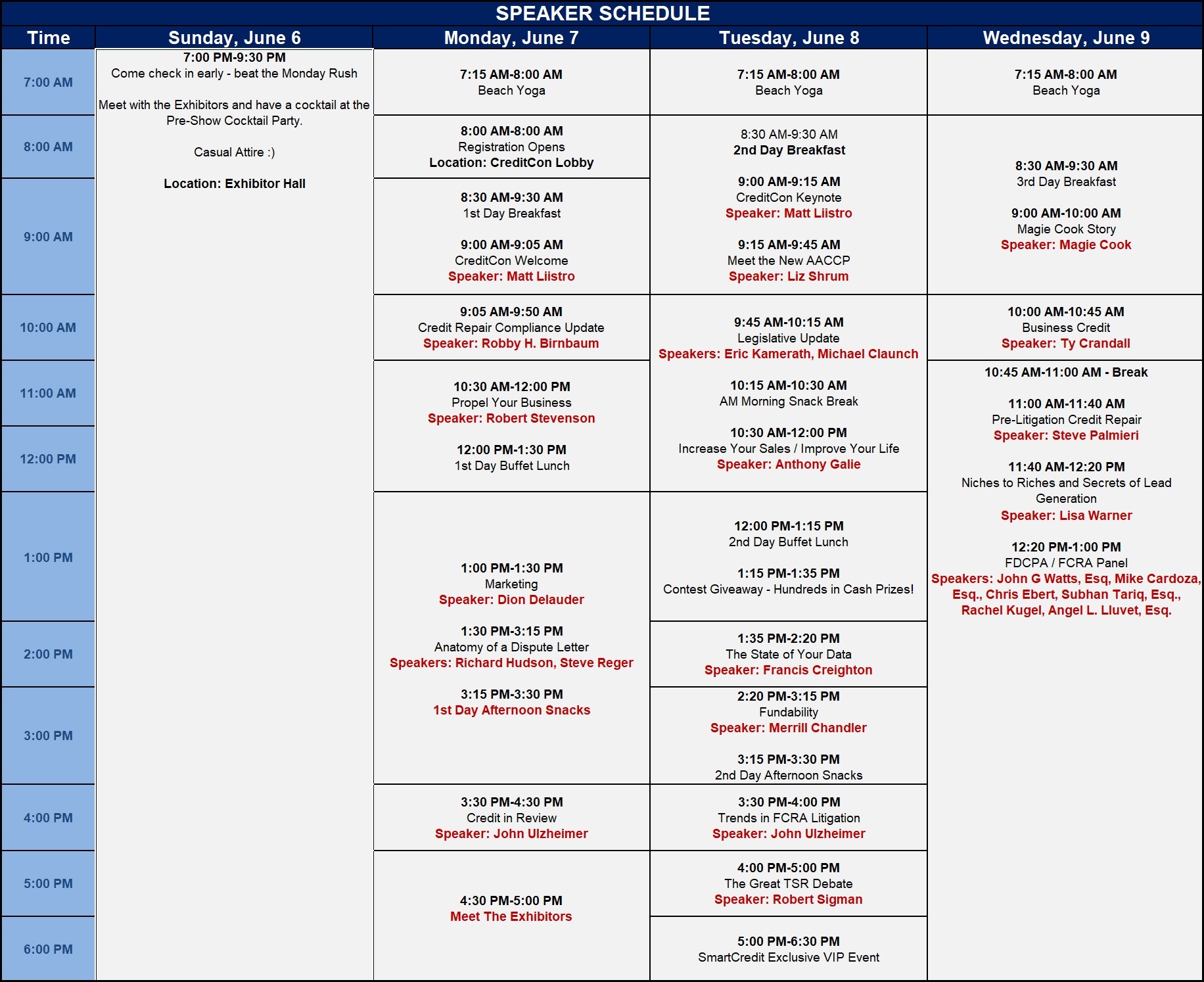

Speakers Schedule